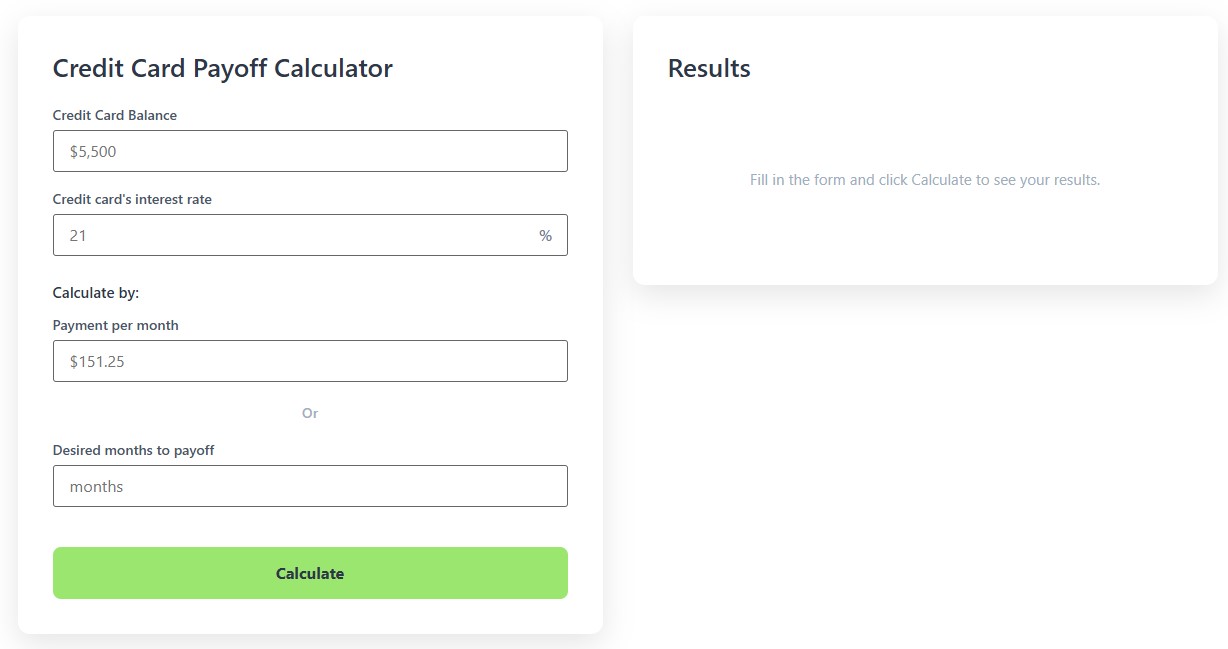

Welcome to the Credit Card Payoff Calculator on CalcVersa — a free online tool that helps you estimate how long it will take to pay off your credit card balance and how much interest you’ll pay along the way.

Use this calculator to plan your repayment strategy, test different payment amounts, and see how extra monthly payments can speed up your payoff timeline.

Start using the calculator below, or explore more financial tools on the CalcVersa

This calculator helps you:

You can use this tool for:

If you’re interested in broader debt planning, check out our Loan Calculator for installment debt scenarios.

Understanding how credit card interest is calculated will help you reduce total costs.

Credit cards typically use compound interest, calculated daily based on your average daily balance.

Here’s how it works:

Your annual percentage rate (APR) is divided by 365 to get the daily periodic rate:

Daily Rate = APR ÷ 365

Interest is then applied each day to your balance.

Making only the minimum payment usually prolongs payoff and increases total interest paid.

Smaller payments mean the balance reduces slowly and interest compounds on higher remaining balances.

Using the calculator is easy:

The results help you understand how your payment strategy affects the time it takes to become debt-free.

Understanding examples can help you plan more effectively:

Example 1 – Minimum Payment Only

→ Estimated payoff time: ~48 months

→ Total interest paid: $1,950 (example)

Example 2 – Increased Payment

→ Estimated payoff time: ~21 months

→ Total interest paid: $900 (example)

This demonstrates the benefit of increasing monthly payments.

Here are ways to reduce debt faster and save on interest:

Paying extra each month reduces principal faster and lowers interest.

Tax refunds, bonuses, or extra cash can make powerful one-time reduction payments.

Both methods have benefits depending on your motivation and financial situation.

Avoid adding new debt while paying off existing balances.

For planning long-term strategies with multiple accounts, consider using additional budgeting tools and calculators from the CalcVersa suite.

It’s an online tool that estimates how long it will take you to pay off your credit card balance based on your payments and interest rate.

Credit card interest accumulates daily, so slower payments mean more interest accrues over time.

Yes. Paying more than the minimum reduces your principal faster and significantly lowers total interest.

Estimating payoff time helps you plan a strategy to become debt-free faster and avoid long-term interest costs.

This tool works on a per-card basis, but running separate calculations for each balance can help you plan a payoff strategy.

CalcVersa provides reliable financial calculators to help you make smarter financial decisions. Once you’re done here, explore other tools like the Interest Calculator or Loan Calculator on the site.