| Payment # | Payment Amount | Principal | Interest | Remaining Balance |

|---|

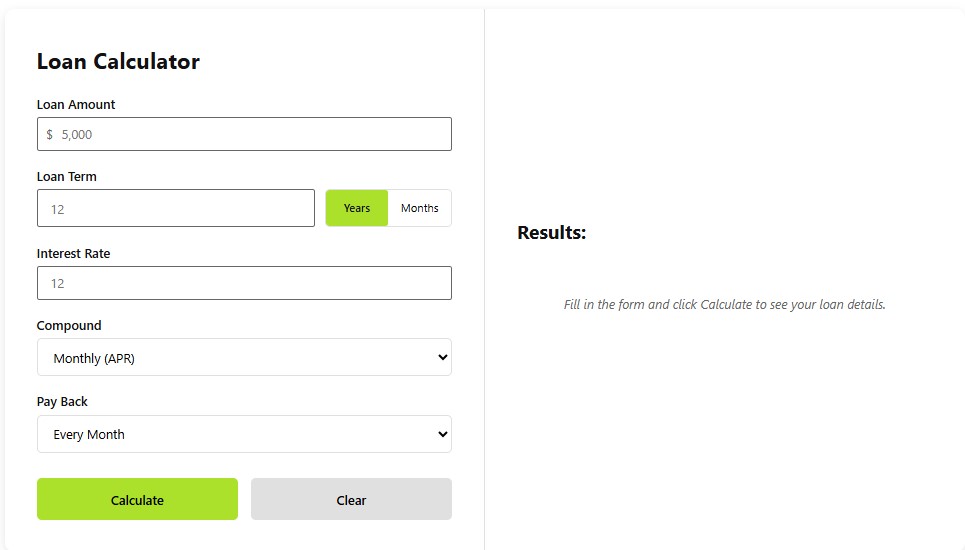

Welcome to the Loan Calculator on CalcVersa – a powerful, free online tool that helps you estimate your monthly loan payments, total interest cost, and full repayment schedule.

Whether you’re planning a personal loan, auto loan, or business financing, this calculator gives you a clear picture of how much you’ll pay based on your loan amount, interest rate (APR), and repayment term.

Start calculating below, or explore more financial tools on the CalcVersa.

Our online loan calculator helps you:

This tool works for most installment-based loans including personal, auto, student, and business loans.

Our online loan calculator helps you:

Review your monthly payment and total repayment details.

M = P × (r(1 + r)^n) / ((1 + r)^n − 1)

Where:

This amortization formula ensures that each payment covers both interest and principal over time.

If you want to analyze interest separately, try the Interest Calculator on CalcVersa to compare rate impacts

Calculate car loan payments before buying a vehicle.

Plan repayment schedules for startup or expansion financing.

Estimate education financing repayment timelines.

Most installment loans follow this structure.

For home financing, consider using a dedicated mortgage calculator available on the CalcVersa website.

Understanding examples helps you make better decisions.

Example 1:

Loan Amount: $10,000

Interest Rate: 7%

Term: 5 Years

Estimated Monthly Payment: Approximately $198

Example 2:

Loan Amount: $25,000

Interest Rate: 5%

Term: 3 Years

Estimated Monthly Payment: Approximately $749

Longer terms reduce monthly payments but increase total interest paid over time.

For example:

Understanding this balance is key to smart financial planning.

Explore more financial calculators on the CalcVersa to compare options.

Making additional payments toward your principal can:

If you are planning early repayment strategies, consider using an extra payment or amortization calculator available on CalcVersa.

CalcVersa provides reliable online financial calculators to help users make smarter money decisions.

Explore additional tools like savings, mortgage, and interest calculators directly from the CalcVersa.

A loan calculator is an online tool that estimates your monthly payment based on loan amount, interest rate, and repayment term.

APR (Annual Percentage Rate) represents the yearly cost of borrowing, including interest and certain fees.

Yes. Longer terms reduce monthly payments but increase total interest paid.

Yes. This calculator works for most fixed-rate installment loans including personal, auto, student, and business loans.