Welcome to the Interest Calculator on CalcVersa — a free online tool that helps you calculate total interest, final investment value, and compare simple vs compound interest growth.

Whether you’re calculating loan interest, investment returns, or savings growth, this calculator helps you understand exactly how interest impacts your money over time.

Start using the calculator below or explore more powerful financial tools on the CalcVersa.

Our interest rate calculator helps you:

This tool works for:

If you’re calculating monthly loan payments specifically, try our dedicated Loan Calculator on CalcVersa

Understanding the difference between simple and compound interest is essential when calculating returns or borrowing costs.

Simple interest is calculated only on the original principal amount.

Formula:

SI = P × R × T

Where:

P = Principal amount

R = Annual interest rate

T = Time in years

Example:

If you invest $5,000 at 6% for 3 years:

Interest = 5000 × 0.06 × 3 = $900

Final amount = $5,900

Compound interest is calculated on both the principal and accumulated interest.

Formula:

CI = P × (1 + r/n)^(n×t) − P

Where:

P = Principal

r = Annual interest rate

n = Compounding frequency per year

t = Time in years

Example:

$10,000 invested at 5% compounded annually for 4 years grows to approximately $12,155.

Compound interest grows faster because interest earns interest over time.

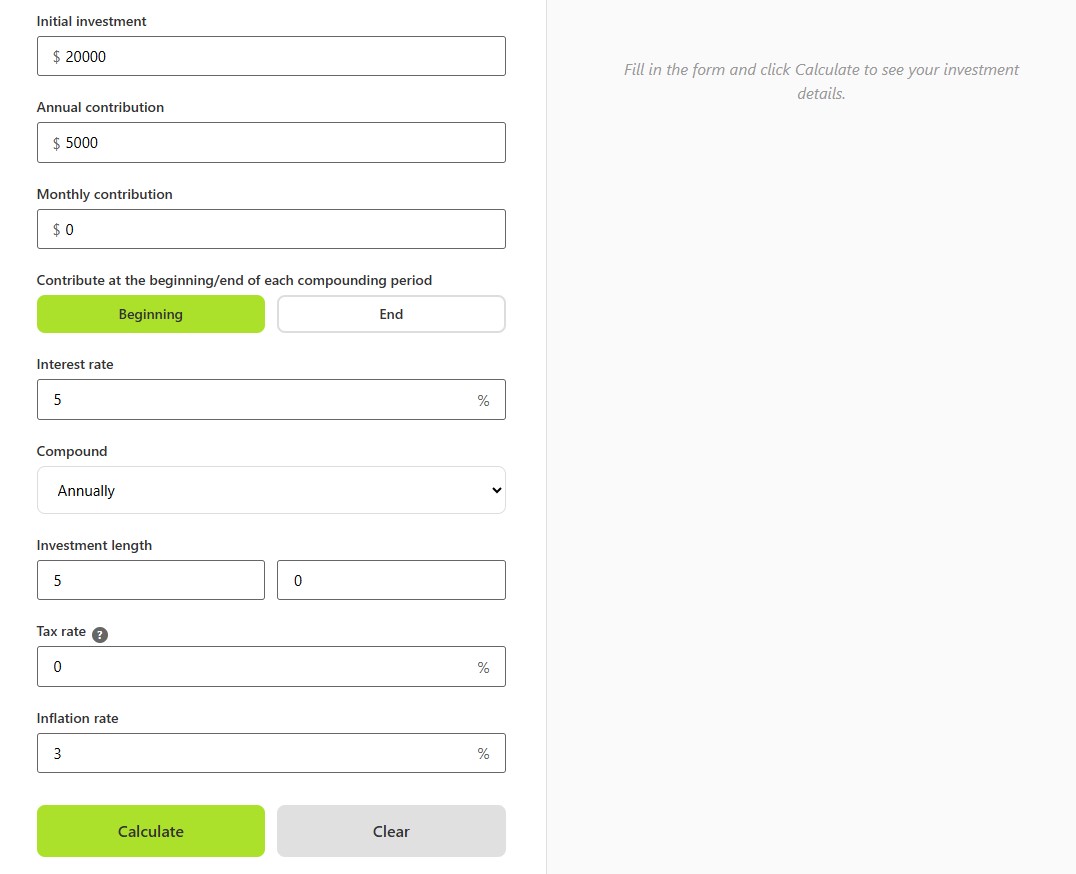

Using this free interest calculator is simple:

You can adjust values to compare scenarios and understand how rate or time changes affect your results.

Real examples help illustrate how interest works.

Example 1 – Simple Interest

Principal: $8,000

Rate: 4%

Time: 5 years

Interest earned = $1,600

Final amount = $9,600

Example 2 – Compound Interest

Principal: $15,000

Rate: 7%

Time: 6 years

Compounded annually

Final amount ≈ $22,506

These examples show how powerful compounding can be over longer time periods.

Interest affects both borrowing and saving decisions.

When borrowing:

Higher interest rates increase total repayment cost.

When investing:

Higher rates accelerate wealth growth, especially with compound interest.

Understanding interest helps you:

To calculate loan-specific interest and monthly payments, use the Loan Calculator on CalcVersa.

For long-term wealth growth projections, explore other financial calculators available on the CalcVersa website.

Even a 1% difference in interest rate can significantly impact total returns or loan costs over time.

For example:

$20,000 invested at 5% for 10 years ≈ $32,577

$20,000 invested at 6% for 10 years ≈ $35,817

That small difference results in over $3,000 additional growth.

This is why comparing rates carefully is essential before committing to loans or investments.

An interest calculator is an online tool used to compute total interest earned or paid based on principal, rate, and time.

You can calculate simple interest using the formula P × R × T. Compound interest uses P × (1 + r/n)^(n×t).

Simple interest is calculated only on the principal. Compound interest is calculated on both the principal and accumulated interest

Yes. This tool can estimate loan interest, but for full monthly repayment breakdowns, use our Loan Calculator.

Because interest earns additional interest over time, creating exponential growth.

CalcVersa provides easy-to-use online calculators designed to help users make informed financial decisions.

Explore additional tools like the Loan Calculator and other financial planning calculators on the CalcVersa.